Have you ever thought about what goes into the cup of coffee you grab each morning?

What about the fuel you use to fill your tank each week? Most of us never realize it, but virtually all goods begin with commodities.

Commodities play a crucial role in the financial market, as they are essential for producers and manufacturers. Essentially, a commodity is a fundamental raw material or basic product used in the production of goods and services that we rely on in our daily lives.

A diverse range of commodities exists, including oil, gas, coffee, soybeans, and rice. These commodities are traded on global exchanges such as:

The Chicago Mercantile Exchange (CME)

The London Metals Exchange

The Intercontinental Exchange (ICE)

Investing in commodities offers investors an opportunity to diversify their portfolios, particularly during periods of market volatility.

Want to learn more about this unique part of the market?

Keep reading to discover the different types of commodities, how their prices are structured, and who determines them in the market.

Commodities exist in various forms, such as grains, energy products, and metals.

Their prices fluctuate in response to economic events, driving waves of buying and selling.

Traders generally don't buy and sell physical commodities.

Commodities are traded in the cash (spot) market and on organized exchanges as futures contracts.

Futures contracts are commonly used for speculation and hedging on exchanges.

Since commodities are traded on exchanges, their prices aren’t set by a single individual or entity. Various economic factors and catalysts influence and drive commodity prices daily.

Weather significantly impacts the prices of agricultural commodities, particularly in the short term. If adverse weather conditions affect supply in a specific region, the corresponding commodity’s price is directly impacted. This applies to crops like:

Gold is one of the most actively traded commodities, valued for its use in jewelry and other products. Additionally, it is widely regarded as a strong long-term investment option.Silver and copper are additional commodities classified under the metals group.

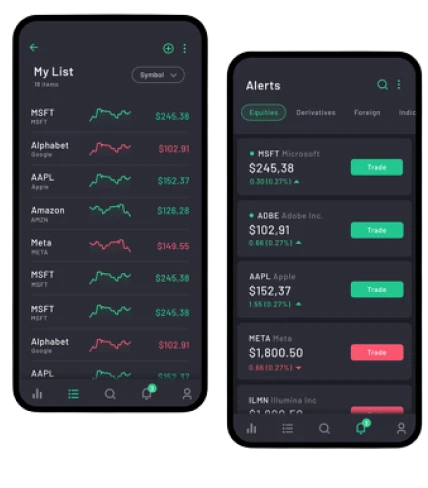

With DDB, you can trade Contracts for Difference (CFDs) based on commodities as the underlying asset. This allows you to take long or short positions on a company’s shares without actually owning them.

The advantage of trading CFDs is the ability to speculate on both price increases and declines while also being eligible for dividends if the company issues payouts to shareholders.